Utah Solar Panel Credit

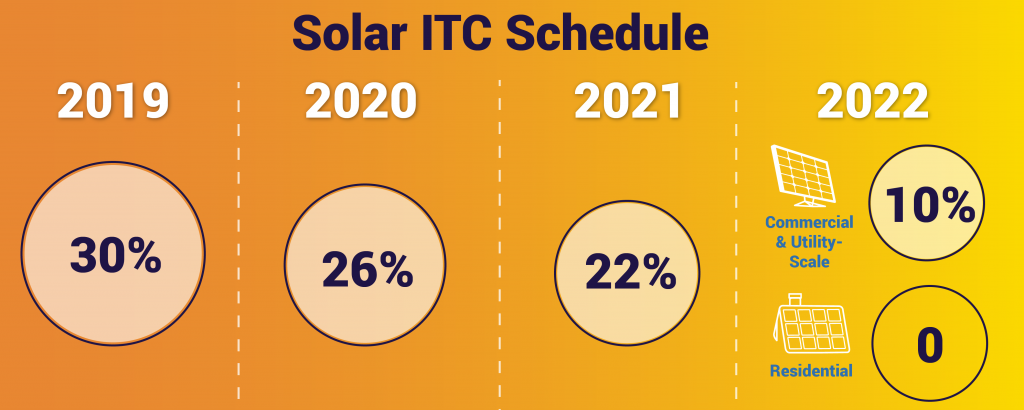

The biggest advantages in utah for installing solar panels are the state tax credit and the 26 federal tax credit.

Utah solar panel credit. Dolla dolla bill y all. After accounting for the 26 federal investment tax credit itc and other state and local solar incentives the net price you ll pay for solar can fall by thousands of dollars. And of course utahns also benefit from the federal solar tax credit. This means that rooftop solar panels in utah could produce more power than solar systems in other parts of the country.

An average sized residential solar. Renewable energy systems tax credit restc high cost infrastructure tax credit hcitc alternative energy development incentive aedi production tax credit ptc well recompletion. Learn more and apply here. Utah also receives some of the highest levels of solar irradiation in the country.

That s in addition to the 30 percent federal tax credit for solar not a bad deal for a system that can save you thousands each year on your energy costs. The commercial investment renewable energy systems tax credit for solar photovoltaic systems is refundable and covers up to 10 of. Given a solar panel system size of 5 kilowatts kw an average solar installation in utah ranges in cost from 12 878 to 17 422 with the average gross price for solar in utah coming in at 15 150. A rooftop solar tax credit is also available for larger commercial projects.

Rooftop solar for your business. State led market options study. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing. You can claim 25 percent of your total equipment and installation costs up to 1 600.

The solar income tax in utah because utah has a state income tax they can use this tax to incentivize solar. Whether or not you re getting any utility rebates everyone in utah is eligible to take a personal tax credit when installing solar panels. As of september 2020 the average solar panel cost in utah is 3 03 w. Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not exceed certain limits.

If you install a solar panel system on your home in utah the state government will give you a credit on your next year s income taxes to reduce your solar costs. This solar tax credit is a dollar for dollar credit deducted from the utah state taxes that homeowners would have owed the state. The utah solar tax credit officially known as the renewable energy systems tax credit covers up to 25 of the purchase and installation costs for residential solar pv projects capped at 1 600 of cost whichever is less. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum of 2 000.

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/WKTJ2BWUA5GZFNXZ73RIVTQ47M.jpg)

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/KI7PZRE5TJBILC4QLF3SEI362Q.jpg)

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/CFMREWNM2ZG4VEMDWWXDR2STH4.jpg)

/arc-anglerfish-arc2-prod-sltrib.s3.amazonaws.com/public/ZZSMTHNLHJCJROSNTVBVZODORQ.jpg)